voluntary life and ad&d child

The Voluntary Life and ADD Insurance is convertible or portable for eligible individuals. Peralta CCD and Voya will have a Voluntary Life ADD Open Enrollment from September 2 through September 30 2021.

Voluntary Benefits Life And Ad D

Life and ADD insurance.

. Children only 15 percent of your coverage for each child SpouseDomestic Partner and Children. Your cost for voluntary ADD coverage is paid on a pre-tax basis. The employee pays the monthly premium to the insurance company offering the policy.

A child may not be covered by more than one employee. They provide you with the ability to make sure that your family will be financially secure if you happen to pass away. 1 Employers have an important role to play to give families the protection they need and we are your best partner for group and voluntary life.

As with any type of life insurance plan voluntary life and ADD is a financial tool that provides a sum of money to your beneficiary upon your death. You may purchase coverage just for yourself or for you and your family. Voluntary Life and ADD Benefits Mutual of Omaha If you want a greater level of protection City of Ennis provides you with the opportunity to elect Voluntary Life Insurance on yourself as well as your family.

Employees electing voluntary life will also have the opportunity to elect coverage on their spouse andor children. Voluntary ADD Coverage Amounts for SpouseDomestic Partner and Children. Voluntary accidental death and dismemberment insurance or voluntary ADD insurance is often offered by employers similar to voluntary life insurance.

You can choose the Voluntary ADD option that meets your needs. Eligible employees and dependents can elect up to the following Guaranteed. What is voluntary Child life and ADD.

If youre young and unable to qualify for good rates from an insurer whether its due to a preexisting medical condition or another issue voluntary life. Your cost for child life coverage is the same no matter how many eligible children you insure. Voluntary group accidental death and dismemberment ADD insurance is a simple way for employees to supplement their life insurance coverage with additional protection if they or a family member dies or is dismembered as a result of a covered accident.

Dependent coverage is a percentage of the employees elected amount with a 25000 maximum per child. Amounts over the GI and subsequent elections may require EOI. Voluntary ADD coverage amount up to 5000 per year for a maximum of 5 years to your covered dependent child who is enrolled in a legally licensed child care center.

Dependent coverage is contingent on you having Voluntary Life and ADD coverage. The amount of the ADD Insurance Benefit for Loss of life is equal to the. You can choose to cover your dependent spousedomestic partner and children with ADD coverage.

Features of the Plan Your employers plan includes Voluntary Accidental Death and Dismemberment ADD Insurance which would pay an additional benefit up to the amount of your. Did you know just 54 of Americans had life insurance coverage in 2020. INCREASED DEPENDENT CHILD BENEFIT The voluntary ADD benefit amount will be increased to 50 percent of your voluntary ADD amount up to 20000 if.

O 1 to 5 times your base annual earnings o The maximum amount of coverage you can receive is 1500000. A request to increase the voluntary ADD only requires a Benefit EnrollmentWaiver Form. The total cost is 021 cents per 1000 of coverage for Employee Only option.

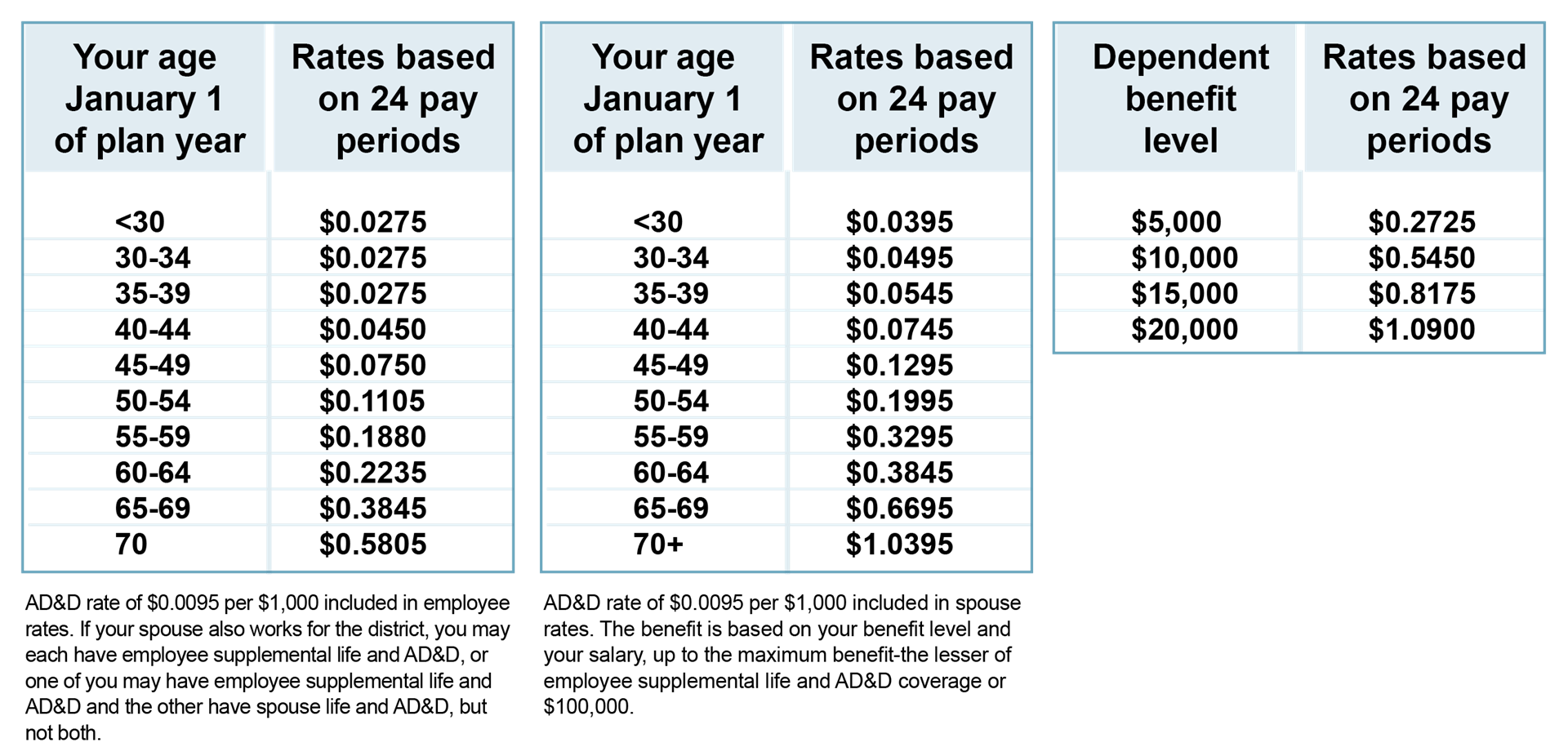

As a new hire employee you may elect up to the Guarantee Issue GI amounts noted below without Evidence of Insurability EOI. In addition to the basic ADD insurance coverage provided by HSHS you can purchase more coverage separate from life insurance for you and for your family through Securian. Child life and ADD options are available at 5000 10000 15000 or 20000.

You must elect Voluntary Life coverage for yourself in order to cover your spouse andor children. Voluntary Accidental Death and Dismemberment VADD is an affordable limited form of life insurance that provides a cash benefit in the event of a fatal or disabling accident. Like any other life insurance program voluntary life insurance doles out a payment or death benefit to the beneficiary in your plan upon your death.

Coverage options and cost Coverage amounts are multiplied and then rounded to the next higher 1000. Voluntary life insurance and accidental death and dismemberment ADD policies are offered to employees as part of a companys benefits plan and you can typically purchase coverage for yourself your spouse or your children. These policies provide a payout to your beneficiaries if you die or receive a qualifying injury due to an accident such as being hit by a car.

Voluntary life insurance an optional benefit often offered by employers is a plan that provides a cash benefit upon the death of the insured. Enhanced Employee ADD 100 of Life benefit to 500000 Spouse and Children Benefits available once Employee selects Voluntary Benefit Spouse Benefit 20000 to 250000 in 10000 increments not to exceed 100 of Employees amount Guarantee Issue. This is a great opportunity to sign up for additional Life ADD up to the guaranteed issue amounts with no medical questions for you spouse and child dependents.

Voluntary life insurance is a form of group life insurance in which an employer takes out a supplemental life insurance policy on behalf of their employees to provide them with additional coverage. MetLife Voluntary LifeADD Plan General Plan Information Eligibility All Full-Time Employees Working 30 Hours Per Week Who Pays For Coverage Employee Voluntary Life Benefit Employee Spouse Children Life Benefit Amount 25000 Increments to the Lesser of 5 Times Your Basic Annual Earnings or 150000 5000 Increments to a. 30000 Child Benefit 2500 5000 10000 not to exceed 10 of Employees amount Guarantee Issue.

Voluntary Life and ADD Insurance Plan Benefits Employee Life and ADD Insurance 5000 increments to a maximum of 300000 or 5 times your annual earnings whichever is less Spouse Life and ADD 5000 increments to a maximum of 300000 Children Life and ADD Insurance 2000 increments to a maximum of 10000. Its more important than ever to help employees protect their families. Voluntary ADD coverage for your Dependents if elected becomes effective.

Voluntary life insurance is an employee benefit option offered by many employers to their employees. Child coverage cannot exceed 50 of the employees coverage. Voluntary Accidental Death Dismemberment ADD Coverage.

The EmployeeFamily option cost is 032 cents per 1000 of coverage.

Group Accidental Death Dismemberment Insurance Plan

What Is Supplemental Ad D Insurance Coverage Seniorcare2share

Voluntary Group Term Life Insurance Professional

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

Term Life Insurance With Living Benefits 3 Best Companies

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Transamerica Universal Life Insurance

Transamerica Universal Life Insurance

Ad D Vs Accident Insurance As We Always Point Out In Axis Capital Group Accidents Can Always Happen When You Least Expect It But Accident Insurance Ads Axis